It's My House & I Live Here : The Pro's & Con's of the NACA Program

I’ve lived in my current apartment for nearly 8 years. I love everything about it -

the maintenance team answers work orders quickly and resolves all appliance or plumbing issues

the gym, party room, and the pool

the fact that you need a special key to even get to my floor

What I don’t love about it is that I won’t ever own it. I met with one of my financial advisors. He told me that I’m track with my savings, investments, and debt elimination in order for me to retire at age 60…well 65. There was just one small thing - “I always recommend that my clients do not have housing costs looming over their head during retirement. Their houses should be paid off so that they can afford to retire comfortably. It’s time to buy a house, Courtnie.”

I was gutted. While both of my parents are homeowners, I did not think that it was something in my near future. The interest rates are sky high, the down payment and closing costs were intimidating, and the thought of working with underwriters terrified me.

Then my dear friend Jasmine told me about the NACA program. She and her husband recently moved into their dream home and achieved it through their participation in the NACA program. I looked up the website, signed up for workshop, and quickly wondered if the program was too good to be true.

No down payment?!

No purchase money security interest?!

No closing costs?!

What’s the catch?!

I was paired with a financial advisor who walked me through what I was expected to complete. I learned that the program was not “too good” to be true, because as much as they give, they also require.

Con’s

This program is slow and steady.

Are you on Zillow saving houses? Be prepared to see those houses come and go while you handle all the necessary requisites of the program before you’re qualified by your advisor to start looking at homes. I’ve heard from my advisor and from the workshop facilitator that some people don’t complete the program for lack of patience. When starting the program, understand that it may take anywhere from 6-12 months depending on your financial portfolio. Hang in there and stay the course. Slow and Steady wins the race.

You will need to explain all your income and expenses.

Sigh. I’m a single woman so this part was particularly interesting. The NACA program is more interested in your debt-to-income ratio than your credit score. This means their lender can offer more once they see patterns - patterns for spending, saving, and income. Be prepared to categorize and explain every expense on your credit, debit, and other bank statements. I learned very quickly how much money I waste on eating out/uber eats.

If you owe taxes, you’ll need to pay them.

It is important that you demonstrate financial fitness. Before you can be qualified to look at homes, be sure to make a plan to pay any outstanding tax debt. Note: a payment plan with the IRS or the state is not sufficient to meet this. (Hence, why the climb to qualification might be slow and steady).

Pro’s

The Program truly does not require down payment, PMSI, nor closing costs.

It is an amazing lift off your shoulders in the home buying process to not have these over your head. One thing to keep in mind - you will need to save a certain amount to demonstrate collateral. The amount also helps to determine how much the lender can qualify you for your purchase. The more you save, the higher they can offer you. Saving is really to your benefit.

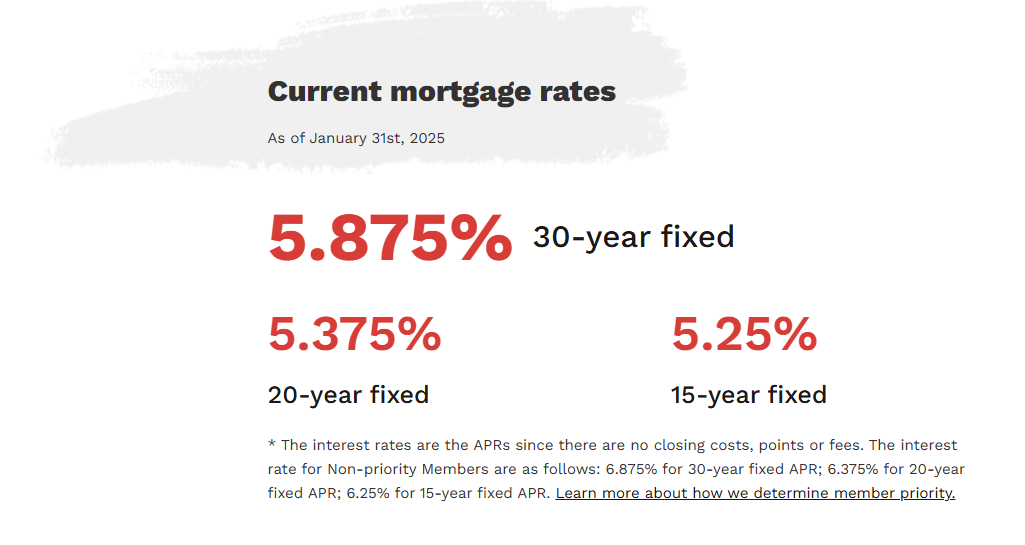

2. The NACA program offers an interest rate below the market mortgage interest rate.

Mortgage interest rates were at their lowest in 2021, going as low as 2.65% for a 30-year fixed mortgage. We may never see interest rates that low again. However, the NACA program offers you a below-market interest rate for your home. Your financial advisor will chat with you about your options.

3. You will clean up for your finances quickly & you’ll be ready for the underwriters.

Meeting with an advisor, reviewing your finances, and working to a goal really helped me to save money and get rid of some unhealthy spending habits. Every dollar had a purpose because I’m working towards my dream. When the time comes for the underwriters and financial institutions to question your finances or documents, you’re in a much better place than you would be if you didn’t participate in the program. All those questions from your NACA advisor and hours uploading documents will be worth it.

4. You will own your home.

There’s no better feeling than ownership. You will truly be living the American Dream…more importantly YOUR dream. Period.

As you can see, the pro’s outweigh the con’s. Even the con’s are helpful to your bottom line. If you think that you’re ready to start the home buying process, attend a free workshop in your city, visit their website, and download their brochure at NACA.com.